irs child tax credit 2021

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. Filing taxes is how you receive Child Tax Credit payments that you are owed for 2021.

Inflation Ruining Your Budget 3 Clever Ways To Save While Shopping And More In 2022 Child Tax Credit Irs Taxes Tax Refund

These changes reflect that Publication 972 Child Tax Credit has become obsolete.

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

. The Child Tax Credit CTC for 2021 is fully refundable if you or your spouse if filing a joint return have a principal place of abode in the United States for more than half of. 150000 for a person who. The child and dependent care tax credit helps working parents afford the cost of childcare.

Schedule 8812 Form 1040. The IRS on Friday provided guidance on how bona fide residents of Puerto Rico can claim the child tax credit CTC for tax year 2021. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

The American Rescue Plan pandemic relief bill temporarily boosted the credits maximum value to 3600 from 2000 depending on the age of the child and the income of. You should receive the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021.

Under the American Rescue Plan Act ARPA of 2021 allowable expenses have increased from. Section 9601 of the American Rescue Plan Act of 2021 enacted March 11 2021 established Internal Revenue Code IRC 6428B which provides a 2021 Recovery Rebate Credit. Taxpayers should refer to Schedule 8812 Form 1040.

If you opt out of advance payments you are choosing to receive your full Child Tax Credit 3600 per child under age 6 and 3000 per child age 6 to 17 when you file your 2021. On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. For 2021 the maximum child tax credit is 3600 per child age five or younger and 3000 per child between the ages of six and 17.

The guidance provides simplified. For 2021 eligible parents or guardians can receive up to 3600 for each child who. 3600 for children ages 5 and under at the end of 2021.

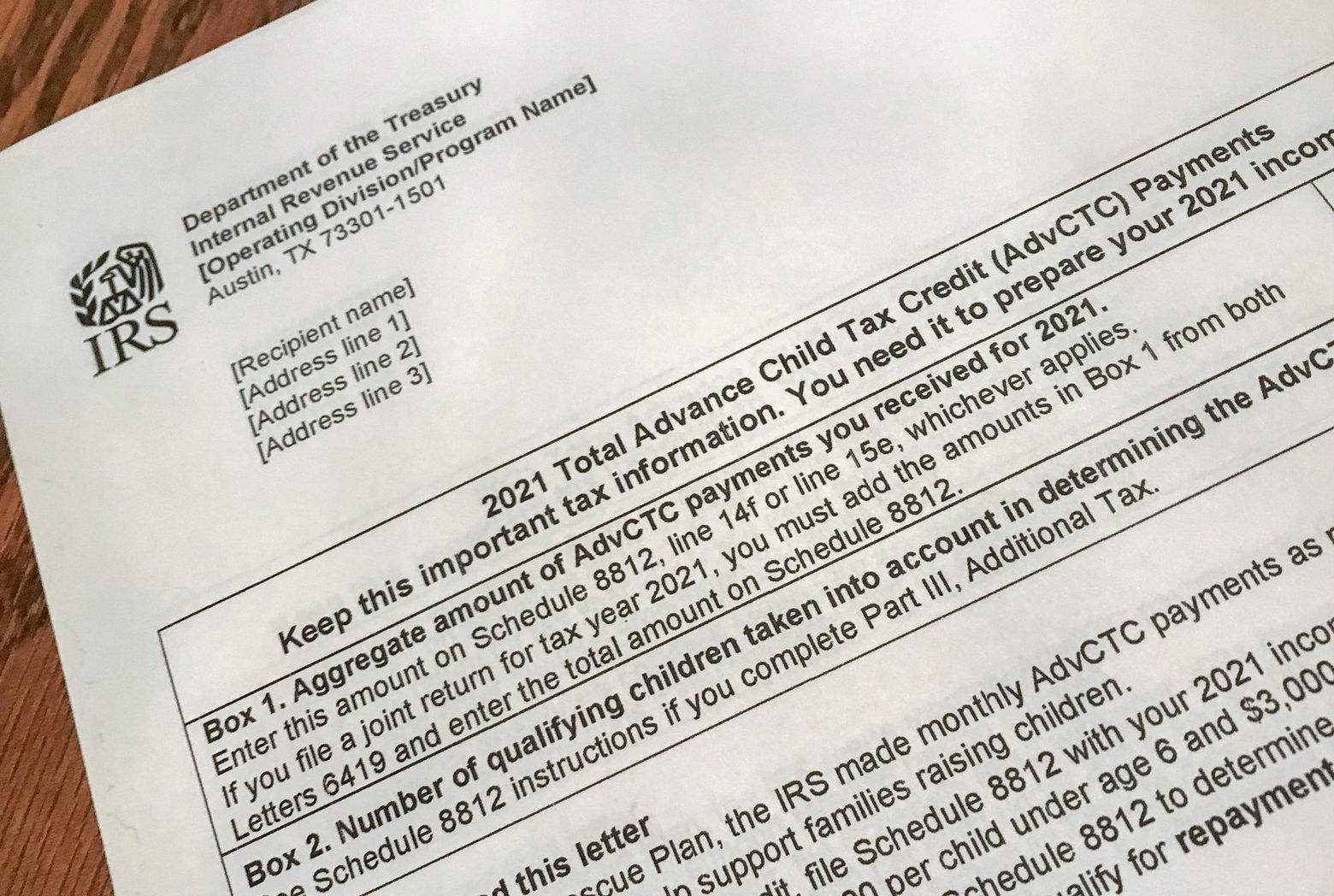

The IRS will send Letter 6419 in January of 2022 to provide the total amount of advance Child Tax Credit payments that were received in 2021. Our child tax credit calculator tells you how much money you might receive in. Prior to the expansion and boost to the Child Tax Credit in the spring of 2021 under the American Rescue Plan the last revision of the tax code in 2017 the Tax Cut and Jobs Act TCJA.

The IRS urges taxpayers. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. 3000 for children ages.

Families with children are now receiving an advance on their 2021 child tax credit. According to an IRS update the agency says it will be releasing refunds that include the CTC on March 1 2022 or later. Use these resources to learn how to claim a child on taxes for the purposes of receiving the remainder of.

The Child Tax Credit Update Portal is no longer available. In previous years 17-year-olds werent. The 2021 Earned Income Tax Credit provides a tax break for low-income workers and families based on their wages salaries tips and other pay as well as earnings from self-employment.

Is the Child Tax Credit for 2020 or 2021. To get money to families sooner the IRS is sending families half of their 2021 Child Tax Credit CHILDCTC as monthly payments of 300 per child under age 6 and 250 per child between. If you do not receive any advance Child Tax Credit payments for a qualifying child you will claim in 2021 you may claim the full amount of your allowable Child Tax Credit for that child when you.

The monthly payments are advances on 50 of the CTC that you can claim on your 2021 tax returns when you file your taxes in early. However the update also says that if you filed your.

Child Tax Credit Delayed How To Track Your November Payment Marca

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Wkrc

Tax Return Check In 2021 Tax Refund Tax Return Business Tax Deductions

Here Is How The Federal Interest Price Can Help Save The Economic Climate During A Recession Tax Refund Interest Rates Check And Balance

Late Child Tax Credit Payments From Irs Arriving Now Fingerlakes1 Com

Tax Season 2022 Tips For A Speedy Refund And How To Avoid Gumming Up The Works The Seattle Times

Irs Child Tax Credit Letter What You Need To Know Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Irs Child Tax Credit Payments Start July 15

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit 2021 Irs Chief Warns Payments May Be Delayed Abc11 Raleigh Durham

Form 4 4rd Party Designee You Will Never Believe These Bizarre Truths Behind Form 4 4rd Part In 2021 Truth Form 4 Income Tax Return

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Irs Urges Parents To Watch For New Form As Tax Season Begins

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

Tax Day Deadline In 3 Weeks What Happens If You File A Tax Extension Tax Extension Tax Refund Filing Taxes

Pin By Bianca Kim On W 2 Irs Tax Forms Tax Forms Irs Taxes

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Irs Has Sent 6 Billion In Stimulus Payments Just In June Here S How To Track Your Money Stimulus Check Irs Second Stimulus Check