tax sheltered annuity 501(c)(3)

A 403b plan allows employees to contribute some of their salary to the plan. In addition you are no longer eligible to sponsor a tax-sheltered annuity plan Internal Revenue Code section 403b retirement plan.

Tsa Tax Sheltered Annuities Teacher Savings Retirement Plans

For further information on tax withholding see 5 USC.

. The amount you contributed should be identified with code H in. Plans sponsored by a 501c3 non-profit organization may be subject to ERISA depending on the design and operation of the plan. A tax-sheltered annuity plan section 403b plan.

Chapter 73 to provide an annuity to a spouse or former spouse to whom payment of a portion of such members retired pay is being made pursuant to a court. We welcome your comments about this publication and suggestions for future editions. Employer payments made by a public educational institution or a tax-exempt organization to purchase a tax-sheltered annuity for an employee annual deferrals are included in the employees social.

Premiums paid as a result of election under 10 USC. Jeff age 75 directed the trustee of his IRA to make a distribution of 25000 directly to a qualified 501c3 organization a charitable organization eligible to receive tax-deductible contributions. However you do not need to wait to receive this form to file your return.

11028 6611b2 substituted if it is a plan sponsored by an organization which is described in section 501c5 and exempt from tax under section 501a and which was established in Chicago Illinois on August 12 1881 for if it is a plan i that was established in Chicago Illinois on August 12 1881. Contributions by your church to a tax-sheltered annuity plan set up for you including any salary reduction contributions elective deferrals that arent included in your gross income. A qualified employee annuity plan A tax-sheltered annuity plan section 403b plan An eligible state or local government section 457 deferred compensation plan to the extent that any distribution is attributable to amounts the plan received in a direct transfer or rollover from one of the other plans listed here or an IRA or.

An organization that is exempt from federal income tax under section 501c3 of the Internal Revenue Code is also exempt from FUTA tax. Appendix 501-591 were complied with. A 403b plan also known as a tax-sheltered annuity plan is a retirement account available to certain employees including public school teachers and nonprofit workers.

501 Dependents Standard Deduction and Filing Information. For wages you should be able to find the withholding-to-date on your last pay slip or statement 2. These rules are covered in Pub.

Enter your total federal income tax withheld to date in 2022 from all sources of income. Any employer who maintains a plan described in section 401a 403a 403b 408k or 501c18 may be subject to an excise tax on excess aggregate contributions made on behalf of highly compensated. Is employed by an organization other than an organization which is described in section 501c3 and with respect to which the minister shares common religious bonds.

571 Tax-Sheltered Annuity Plans. You are either self-employed or employed by an organization that isnt exempt from tax under section 501c3 of the Internal Revenue Code. A 403b plan also known as a tax-sheltered annuity plan is a retirement plan for certain employees of public schools employees of certain Code Section 501c3 tax-exempt organizations and certain ministers.

575 Pension and Annuity Income. 939 General Rule for Pensions and Annuities. A 403b plan also known as a tax-sheltered annuity TSA plan is a retirement plan for certain employees of public schools employees of certain tax-exempt organizations and certain ministers.

You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Employees of tax-exempt organizations established under section 501c3. 544 Sales and Other Dispositions of Assets.

Enter your projected tax for 2022 from Worksheet 1-3 line 13. The credit equals 500 per year over a 3-year period beginning with the first tax year in which it includes the automatic contribution arrangement and may first be claimed on the employers return for the year 2020. Enter the federal tax withholding you expect for the rest of 2022.

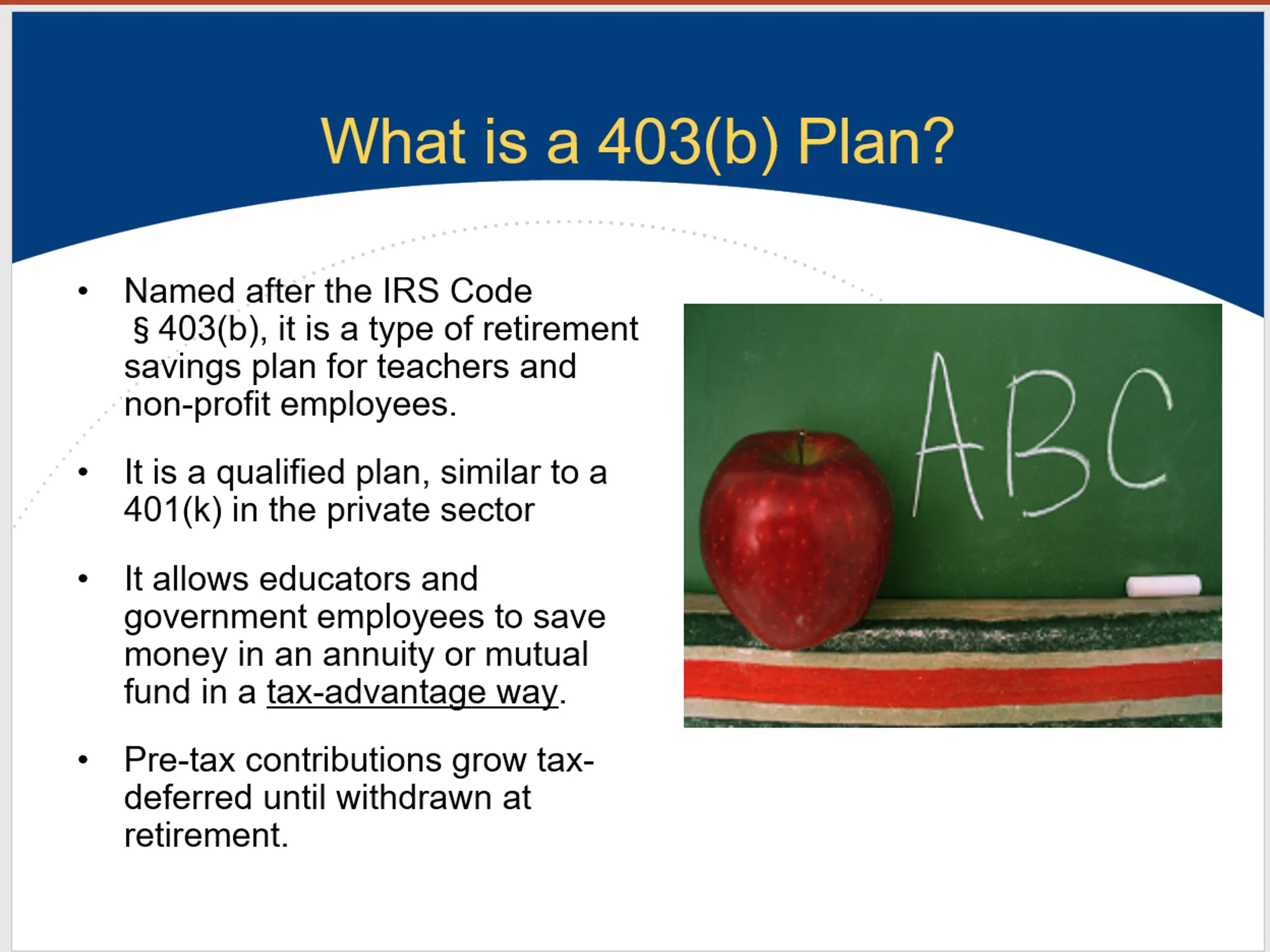

A 403b plan functions similarly to a 401k plan by featuring tax-deferred growth and high annual contribution limits. The TCJA added section 529c3CiIII which provides that a distribution from a QTP made after December 22 2017 and before January 1 2026 is not subject to income tax if within 60 days of the distribution it is transferred to an ABLE account of the designated beneficiary or a member of the family of the designated beneficiary. Tax-Sheltered Annuity TSA Roth Conversion IRA Inherited Beneficial IRA Full 100 Specific Amount Withdraw total free amount without incurring surrender charges.

These organizations are usually referred to as section 501c3. Publication 571 Tax-Sheltered Annuity Plans 403b Plans For Employees of Public Schools and Certain Tax-Exempt Organizations. Ineligible Employer 403b Project - designed to educate IRC Section 501c3 organizations whose tax-exempt status had been automatically revoked per IRC Section 6033j to ensure an employer eligibility.

This limit is reduced by any contributions to a section 501c18 plan generally a pension plan created before June 25 1959 that is funded entirely by employee contributions. Your organizations tax-exempt status has been revoked for failure to file a Form 990 series return for three consecutive years. NW IR-6526 Washington DC 20224.

Ministers employed by a 501c3 organization. Employees save for retirement by contributing to individual accounts. Only public educational institutions or 501c3 tax-exempt organizations may establish a 403b plan.

A 403b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501c3 tax-exempt organizations. Forms and Instructions. The total value of Jeffs IRA is 30000 and consists of 20000 of deductible.

Hurricane Ike disaster area bond treated as a qualified mortgage bond qualified veterans mortgage bond or qualified 501c3 bond a bond issued for the benefit of certain tax-exempt. Applying for 501c3 Tax-Exempt Status PDF. Including any tax-sheltered annuity plan under section 403b.

ITINs assigned before 2013 have expired and must be renewed if you need to file a tax return in 2022. Wages shown in box 1 of Form W-2 shouldnt have been reduced for contributions you made to a section 501c18D plan. Publications 4221-PC PDF 4221.

If you previously submitted a renewal application and it was approved you do not need to renew again unless you havent used your ITIN on a federal tax return at least once for tax years 2018 2019 or 2020. Or a tax-sheltered annuity. This information may be relevant if you purchased health insurance coverage for 2020 through the Health Insurance Marketplace and wish to claim the premium tax credit on Schedule 3 line 8.

You should receive Form 1095-C by early February 20221. But see Reporting by employer later. 571 Tax-Sheltered Annuity Plans 403b Plans 575 Pension and Annuity Income.

Relates to payment of child support alimony or marital property rights to a spouse former spouse child or other dependent of the participant. 590-A Contributions to Individual Retirement Arrangements IRAs. For purposes of section 4975 the term plan does not include a section 403b tax-sheltered annuity plan.

571 Tax-Sheltered Annuity Plans 403b Plans For Employees of Public Schools and Certain. Tax-sheltered annuity plans section 403b plans. 5516 5517 and 5520.

Massmutual What S In A Name A Retirement Plan Comparison

Tax Sheltered Annuity Definition How Tsa 403 B Plan Works

Nonprofit 401 K The 403 B Plan Vs 401 K Plan Shortlister

Who Uses A 403 B Plan Part One By Admin Partners Llc Medium

What Is A Tax Sheltered Annuity

403 B Plans Managing Them Can Be Like Herding Cats Employee Benefits Law Group

/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)

Tax Sheltered Annuity Definition

Module 6 403 B Plans Other Plan Issues Ppt Download

What Is A 403 B Tax Sheltered Annuity Retirement Living

Fiduciary Litigation Best Practices For 403 B Plan Fiduciaries Butterfield Schechter Llp

403b Retirement Plans Fisher 401 K

Retirement Plans Pensions And Annuities

Irs Compliance Guide For 501 C 3 Public Charities Resources For Nonprofit Organizations

:max_bytes(150000):strip_icc()/Safe-Retirement-Withdrawal-Rate-57a521625f9b58974aa2b94a.jpg)