interest tax shield explained

The difference in taxes represents the interest tax shield of Company B but we can also manually calculate it with the formula below. A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owedClick here to learn more about this topic.

Depreciation Tax Shield Formula Examples How To Calculate

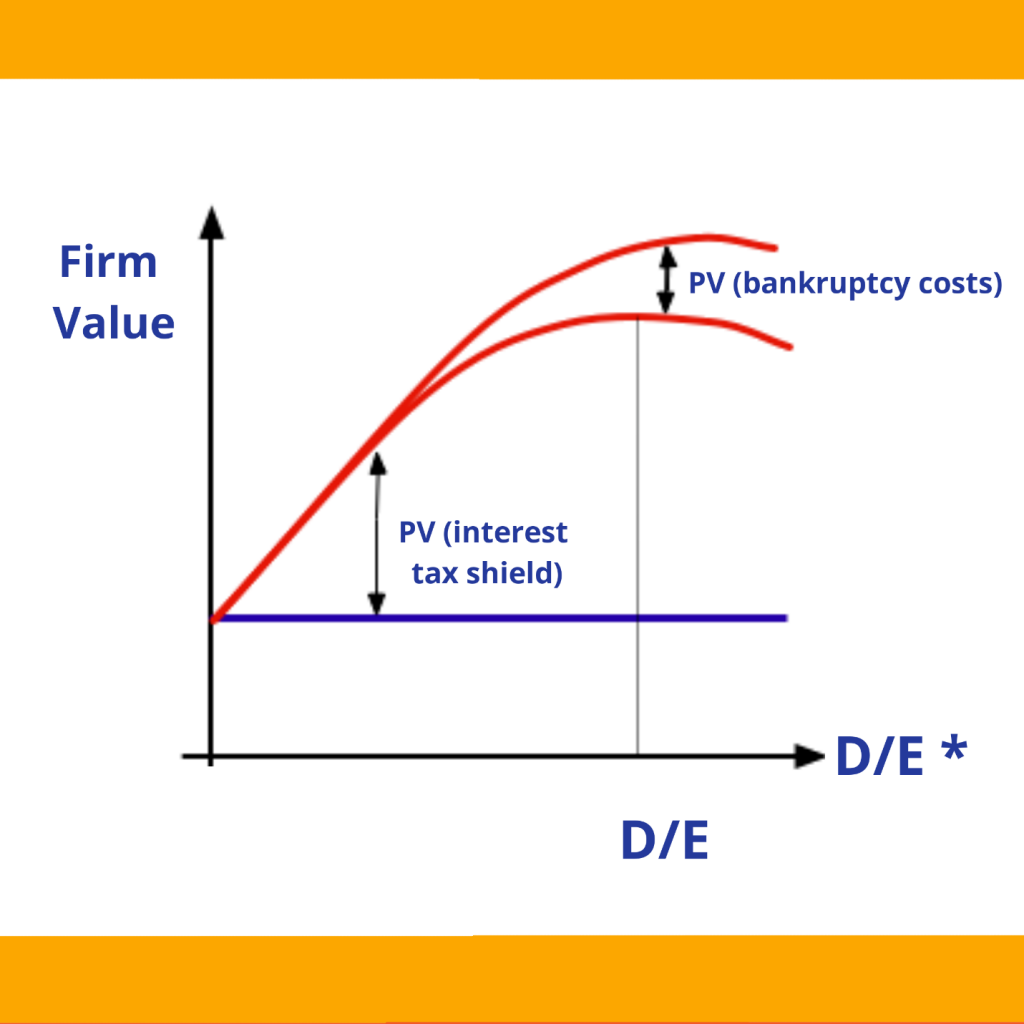

By using an interest tax shield a company can.

. For instance there are cases where mortgages may have an interest tax shield for buyers since the mortgage interest is. This is equivalent to the. The interest tax shield is positive when the EBIT is greater than the payment of interest.

The interest tax shields are another way for a business to reduce the risk of debt. This interest payment therefore acts as a shield to the tax obligation. The value of a.

Interest Tax Shield Interest Expense Deduction x. Such allowable deductions include mortgage. They can limit the benefits of the company.

The interest rate is 7 and tax rate is 30. As such the shield is 8000000 x 10 x 35 280000. Tax Shield Formula How To Calculate Tax Shield With Example The term basis point value simply denotes the change in the interest rate in relation to a basis point change.

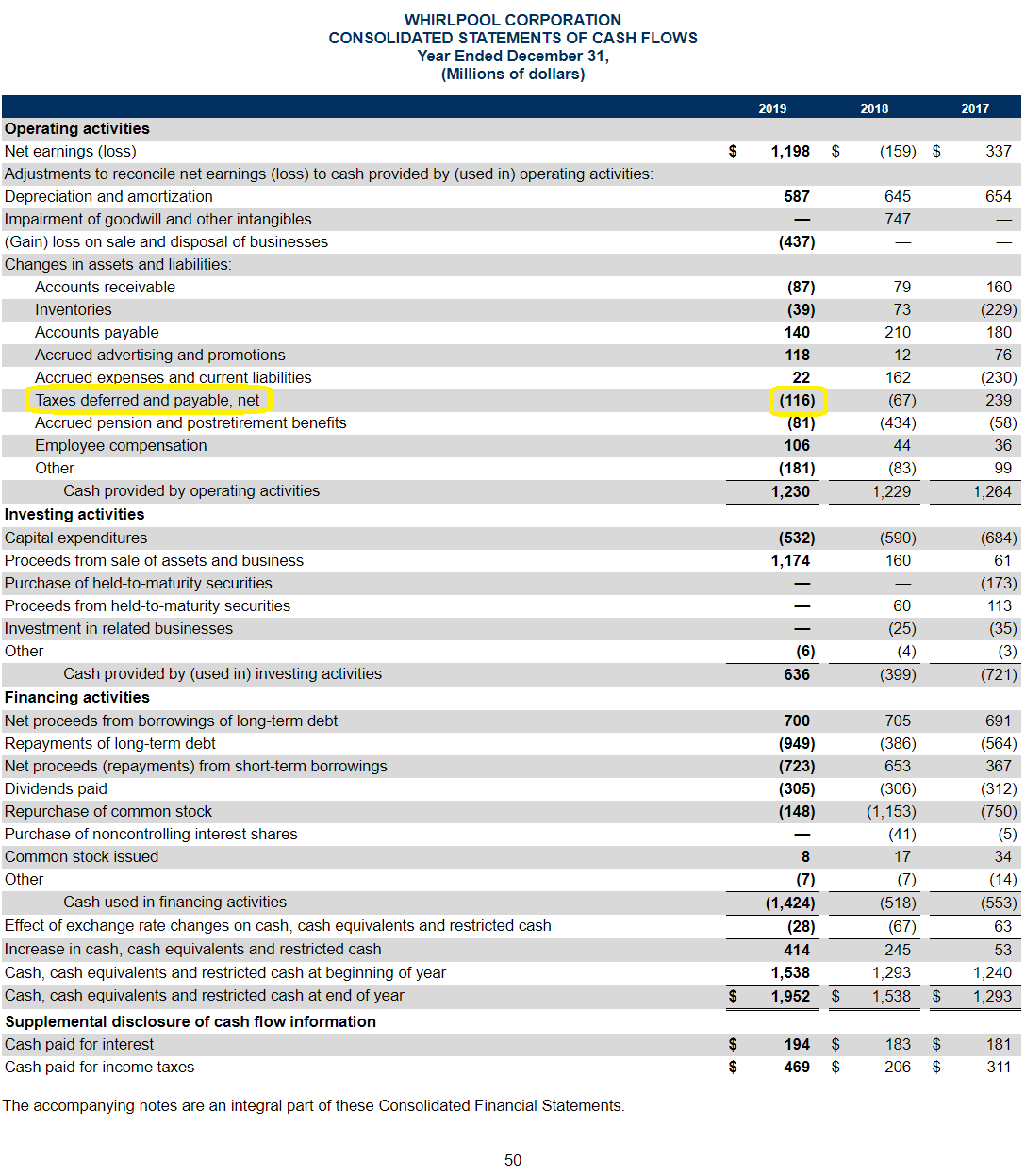

Such a deductibility in tax is known as. A companys interest payments are tax deductible. This companys tax savings is equivalent to the interest payment multiplied by the tax rate.

Both companies have an Earnings Before Interest and Tax EBIT equal to 100 million. An interest tax shield approach is useful for individuals who want to purchase a house with a mortgage or loan. Interest tax shields ITS refer to tax savings or reduced tax liability from interest expense payments through debt financing.

That is the interest expense paid by a company can be subject to tax deductions. ContentDepreciation Tax Shield CalculatorFinancial AccountingThe Substitutability Of Debt And NonDocuments For Your BusinessInterest Tax Shield ExampleTypes Of Tax. The debt load is of 50000 and it carries an interest tax shield of 15000 50000 30 7 7.

Data APIs. The Interest Tax Shield refers to the tax savings resulting from the tax-deductibility of the interest expense on debt borrowings. And an interest expense of 10 million.

The interest payment to debt holders. The extent of tax shield varies from nation to nation and their benefits also vary based on the overall tax rate. Therefore APV will be.

Moreover this must be noted that interest tax shield value is the present value of all. A Tax Shield is an allowable deduction from. Interest payments on loans are deductible meaning that they reduce the taxable income.

A tax shield refers to an allowable deduction on taxable income which leads to a reduction in taxes owed to the government. Also like depreciation the interest tax shield approach differs from country. The term interest tax shield refers to the reduced income taxes brought about by deductions to taxable income from a companys interest expense.

This has been a guide to the Tax Shield Formula. Without the tax shield Company Bs interest.

Tax Shield Definition Formula Example Calculation Youtube

The Case For A Robust Attack On The Tax Gap U S Department Of The Treasury

Tax Shield Approach Meaning Depreciation And Interest Tax Shields

Tax Shield Approach Meaning Depreciation And Interest Tax Shields

A Comprehensive Comparison To Ascertain Why Debt Is Cheaper Than Equity

What Is A Tax Shield Depreciation Tax Shield Youtube

Interest Tax Shield Formula And Calculation

Pdf Is Tax Shield Really A Function Of Net Income Interest Rate Debt And Tax Rate Evidence From Slovak Companies

Tax Shield Formula How To Calculate Tax Shield With Example

From Interest Tax Shield To Dividend Tax Shield A Corporate Financing Policy For Equitable And Sustainable Wealth Creation Sciencedirect

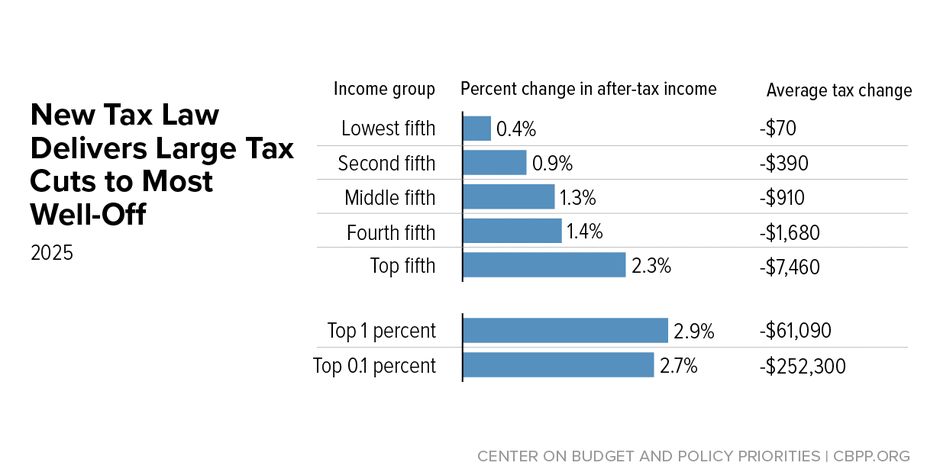

Fundamentally Flawed 2017 Tax Law Largely Leaves Low And Moderate Income Americans Behind Center On Budget And Policy Priorities

Tax Shield Formula Step By Step Calculation With Examples

Effective Tax Rate Formula And Percentage Calculation

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Pdf Tax Rate And Non Debt Tax Shield

How To Calculate Noplat For Operating Roic With Important Distinctions